Good morning!

The goal today is to inform you of my new challenge, and teach you about the millionaire trading mindset.

My mentor taught me this important life lesson today.

Trust me, these words hurt a bit. Actually, they stung a lot. However, he was right. By the end of our conversation, I became ready to accept his ultimate challenge.

“Ken, I am going to stop you from continuing your $500 to $10,000 challenge today”

“As of today, you are done”

“To be honest, I challenged you, because I knew you weren’t quite ready to complete the challenge”

“I taught you all the skills and techniques that I have acquired in the past 25 years of trading. You are no doubt, one of the most talented students I have ever taught.

You are ahead of 95% of all the other people trading on the market.

The one thing you lack is confidence, and that was the reason I challenged you.

That is something I cannot teach, you have to learn it on your own.

Skills aren’t enough to make you a millionaire, you need the mindset, and the confidence.

I have been watching your live stream occasionally, and I noticed that your entries are flawless, you are absolutely great at your entries.

Your mindset is great, and it’s constantly improving. I am confident that your mindset will continue to develop as you gain more experience trading.

Your confidence is lacking, that is why you do not take your wins.

That is why you back out on trades that could have made you a lot of money.

That is why you failed to make the trade on UAL.

Confidence is the expression of competence.

I know you are trying hard to teach your students everything I taught you, but you are working too damn hard.

Conventional wisdom tells you that making money requires you to work pretty damn hard.

I want you to break that myth. You don’t need to work hard to make a ton of money. If you go back and look at your streams, you do a very simple task, and your account spikes up and makes a ton of money.

That is easy money. However, conventional wisdom is what is corrupting your mind.

You are taught from a young age that making money has to be done by hard work. Hence, you don’t have the mindset for easy money, and that’s okay. Understand that making money is easy.

I am telling you today, making money is pretty damn easy. You just need to have leverage.

95% of people think that making money is hard, 95% of people aren’t millionaires. The top 5% of people know that making money is easy. Use leverage.

Do you think that Bill Gates, Warren Buffet, Steve Jobs, or Mark Zuckerberg do all the hard work for their companies? I would hope not.

If you want to be a millionaire, you need to start thinking like a millionaire.

This is what I mean.

The boss of a construction company makes millions of dollars every year, but he doesn’t do any of the hard work, he leverages his employees to do the heavy lifting.

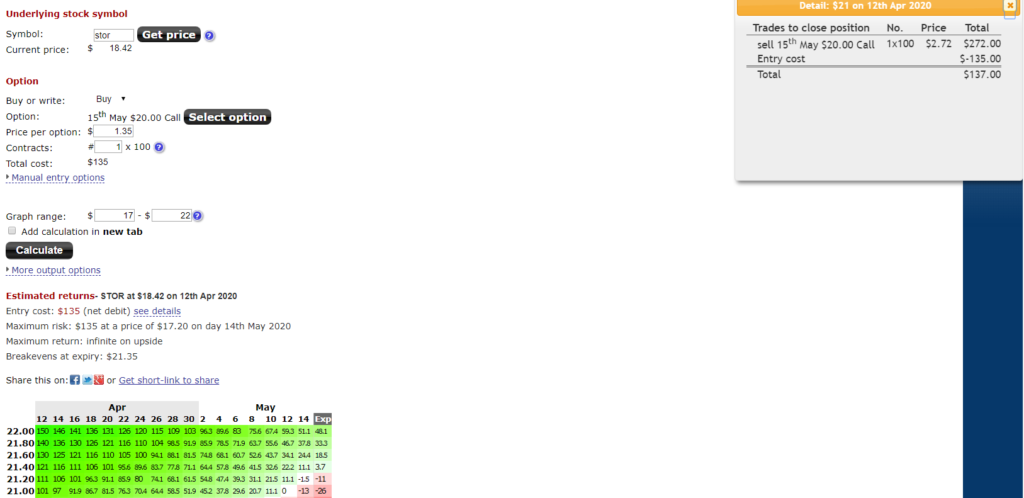

You can make millions of dollars every year without buying lots of stocks and spending your hard earned money by applying leverage with trading options.

In fact, the hardest working people aren’t millionaires.

I am sure the guy who picks up my trash every week works a hell of a lot harder than me. Why isn’t he a millionaire?

How does this apply to you?

Your goal is to teach people. You need to keep it simple.

Not a lot of people want to spend 6 hours watching your videos everyday. You spend too much time trying to teach a skill they can learn from your instructional videos. Save your energy.

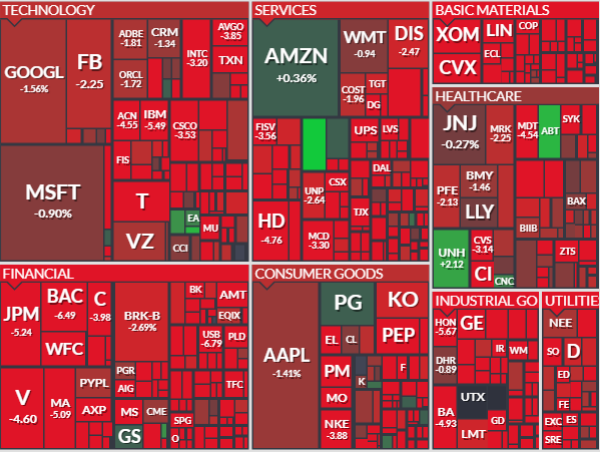

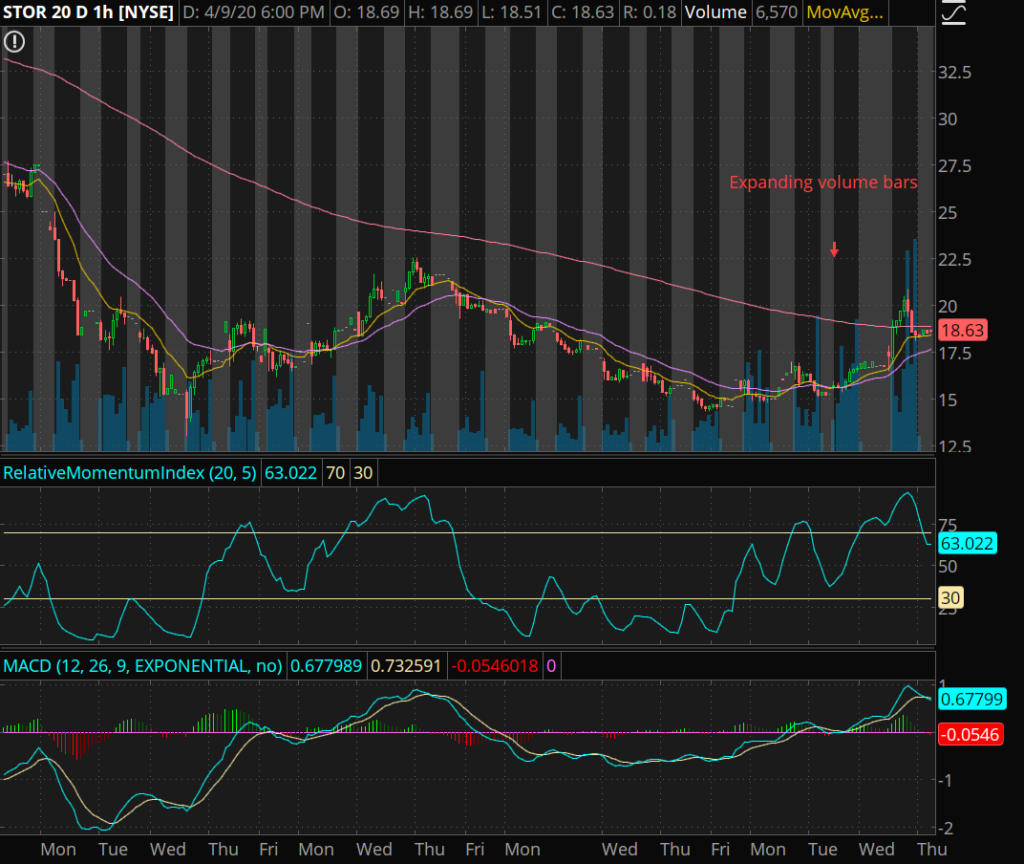

Your bread and butter is 50% profit winners, this can be seen repeatedly in every day trade you enter on your live stream.

You spend 5 minutes scanning the charts everyday, 5 minutes to enter a trade. That is great. Keep it simple. Scan 5 days a week, but only enter a trade 2 to 3 times a week.

The days you don’t see a good set up, just rest. Do something else and enjoy life. Keep it simple and easy.

5 minutes scanning x 5 days = 25 minutes. 5 minutes trading x 3 days = 15 minutes. Total time spent a week is 40 minutes.

I want you to pick 2 to 3 days a week, and make 3 day trades. Aim to hit those 50% trades.

If you land two 50% winners a week, you will double your money every week very easily.

However, if you do see a SOLID money pattern, take the swing. Use absolute precision.

This is productivity. More RESULTS with LESS TIME.

The reason you don’t have a lot of subscribers or viewers is because of two main reasons.

You aren’t keeping it simple enough. You aren’t making big results.

Let the money do the talking and I guarantee that people will pay more attention.

I am stopping you, because I believe you are ready for the next challenge.

You need to stop wasting your time. Take control of your confidence.

You don’t need to prove anything to anybody. What you need to do is focus on yourself.

If you want to help other people, the first thing you need to do is help yourself first.

Remember, in an airplane they always tell you to put on your oxygen mask first before assisting other people.

You have already mastered the art of trading, now you need to play for real.

This is your new assignment:

Options Trading – FU Money Rags to Riches Day 1

Start with $1,000 and commit to this weekly ritual until you hit $30,000. Then commit to this ritual daily. You will see results a lot faster, and many people will start paying attention.

I believe you can complete this challenge in under 2 months.

Also, there is one caveat to this challenge. You must be withdrawing money occasionally to pay your bills. You must also use your profits to upgrade your setup. Buy a better headset, a camera, and another computer monitor.

I want this side hustle to overcome your day job income.

Once you triple your day job income. This will become your new day job.

This is the challenge that is going to push you to become a millionaire.”

Stay tuned, learn more, ask questions. Become a 6 digit survivor. Check out the live stream.

Join my robinhood team and get a free stock here

Learn about my Indicators here.

Become a member and learn!

Disclaimer:

I want to point out, I am not a registered investment adviser or broker/dealer. I am a highly profitable options trader who has been successful time after time, and I have changed the lives of many people through the art of trading on the stock market.

– Ken