Hey guys,

It is 1:30 AM CST as I am posting this. I want you guys to get this as soon as possible before the results tomorrow.

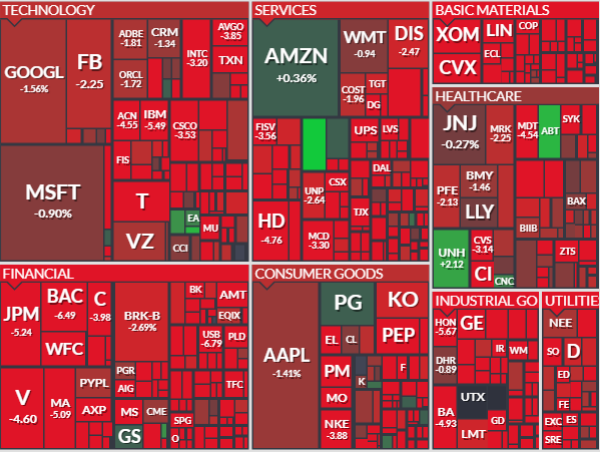

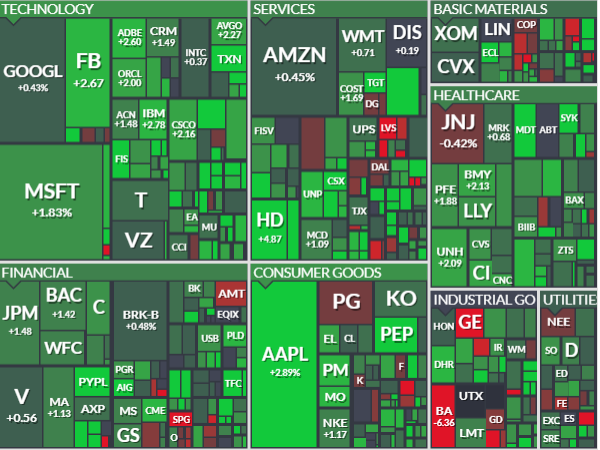

This is my take on the end of the day market crash on May 12, 2020.

Stay tuned, learn more, ask questions. Become a 6 digit survivor. Check out the live stream.

Join my robinhood team and get a free stock here

Learn about my Indicators here.

Become a member and learn!

Disclaimer:

I want to point out, I am not a registered investment adviser or broker/dealer. I am a highly profitable options trader who has been successful time after time, and I have changed the lives of many people through the art of trading on the stock market.

– Ken