I made a day trade on 4/9/20.

Day trading is when you purchase and sell a stock or an option on the same day.

The ratio for this is simple. The total number of purchases is your governor limit. When the total number of sold purchases = total number of purchases, you have reached your governor limit which results in a day trade.

For example, if you purchase 5 shares of a stock and sell 5 shares of a stock in the same day, that is considered a day trade.

If you purchase 5 shares of the stock in the morning, sell 3 shares in the morning, and 2 shares in the afternoon, that is also a day trade.

What if you buy 5 shares and sell only 1 share?

That will still count as a day trade, even though you did not reach the limit of 5 shares, which means you can still sell the remaining 4 shares without going over the one day trade.

If you buy 5 shares, sell 5 shares, then buy 1 share, you would have done two day trades.

One day trade for the 5 purchased 5 sold, and one day trade for the 1 share.

The SEC has a law for pattern day trading which prohibits anyone with less than $25,000 in their account to commit more than 3 day trades in a given week, before being flagged as a pattern day trader.

The SEC day trading rules can be found here:

https://www.sec.gov/fast-answers/answerspatterndaytraderhtm.html

If you are flagged as a day trader, you must abide to this limit, and always maintain $25,000 in your account at the end of the day, or your day trading activity will be limited.

Therefore, if you are just starting out as a trader, be sure to stay under 3 day trades a week.

I typically teach swing trading, but sometimes I do make some day trades.

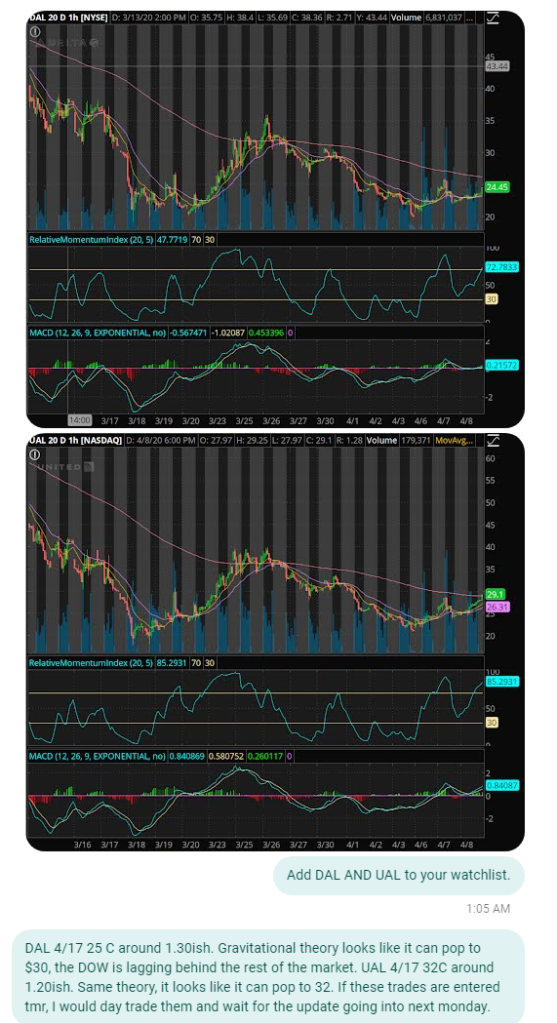

Take a look at the example of the trade I did today on DAL:

This was the alert on 4/8/20.

I used 5 elements to predict the next move in the market:

- Gravitational Theory

- Catalyst Theory

- Support and Resistance

- MACD

- RSI

At 8:20 AM CST on 4/9/20, I saw that the stock price popped, and I quickly drew the Fibonacci retracement line.

I saw that the stock was following a bull flag consolidation between $24.71 and $24.97.

I thought to myself, “If the stock price breaks through $24.97, it could send the price up to $25.50, so I alerted my students that the trade should be locked in at $25.50.”

If you would have taken the option call of 4/17 DAL $26 C at 8:40 AM for $150 a contract, you could have made a day trade in 30 minutes for $192 per contract. That is a nice +$42 win per option contract.

In other words, that is 1.28x or a 28% win in 30 minutes. That is definitely way more gains than you would make leaving your money in the bank for one year.

Think about it, you could have took $1000 and turned it into $1280 in 30 minutes!

This is what the chart looked like as the day approached 10:00 AM CST. As you can see, timing is everything! If you were to exit the trade late, you would have loss money.

I hope this provides a valuable lesson for people wanting to learn some day trading techniques.

Stay tuned, learn more, ask questions. Become a 6 digit survivor. Check out the live stream.

Join my robinhood team and get a free stock here

Learn about my Indicators here.

Become a member and learn!

Disclaimer:

I want to point out, I am not a registered investment adviser or broker/dealer. I am a highly profitable options trader who has been successful time after time, and I have changed the lives of many people through the art of trading on the stock market.

– Ken