Vienna, Austria is a popular destination for Christmas due to its holiday markets and traditional Christmas events. Here are some suggestions for things to do in Vienna during the holiday season:

- Visit the Christmas markets — Vienna has a number of Christmas markets that offer holiday-themed goods and food, such as the Christkindlmarkt at the Rathausplatz and the Wintermarkt at the Spittelberg.

- See the holiday lights — Vienna is known for its elaborate holiday light displays, which can be seen throughout the city. Some of the best places to see the lights are the Ringstrasse, the Stephansplatz, and the Mariahilfer Strasse.

- Attend a holiday concert or show — Vienna is home to a number of classical music venues, such as the Musikverein and the Konzerthaus, that host holiday-themed concerts and shows.

- Take a tour of the city — Many tour companies in Vienna offer holiday-themed tours of the city, such as a Christmas lights tour or a tour of the Christmas markets.

- Sample traditional Austrian holiday foods — Vienna is known for its traditional holiday foods, such as roast pork with dumplings and sauerkraut, and sweet treats like linzer torte and vanilla crescents.

These are just a few suggestions for things to do in Vienna during the holiday season. The city also has a number of museums, shops, and restaurants that are worth checking out, as well as outdoor activities such as ice skating and skiing in the nearby mountains.

Don’t forget to hype it on AreaHype!

Download today! https://hypex.app/h/download

Check out what we do! https://www.areahype.com

Feel free to contact me and follow me on LinkedIn.

Ken Ma

Strategic Partnerships | AreaHype

————————————————————————————————————————–

Download today!

https://hypex.app/h/download

iOS – Download

Android – Download

Check out what we do!

https://areahype.onuniverse.com/

Disclaimer: This is not a paid advertisement.

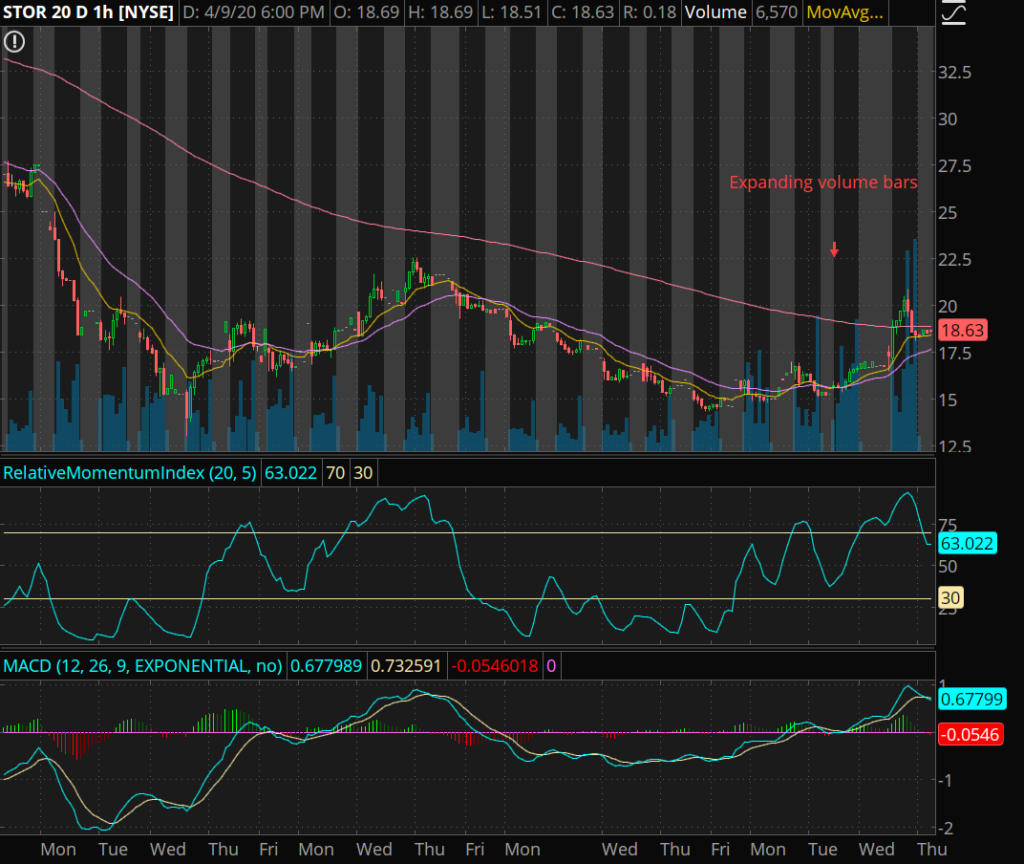

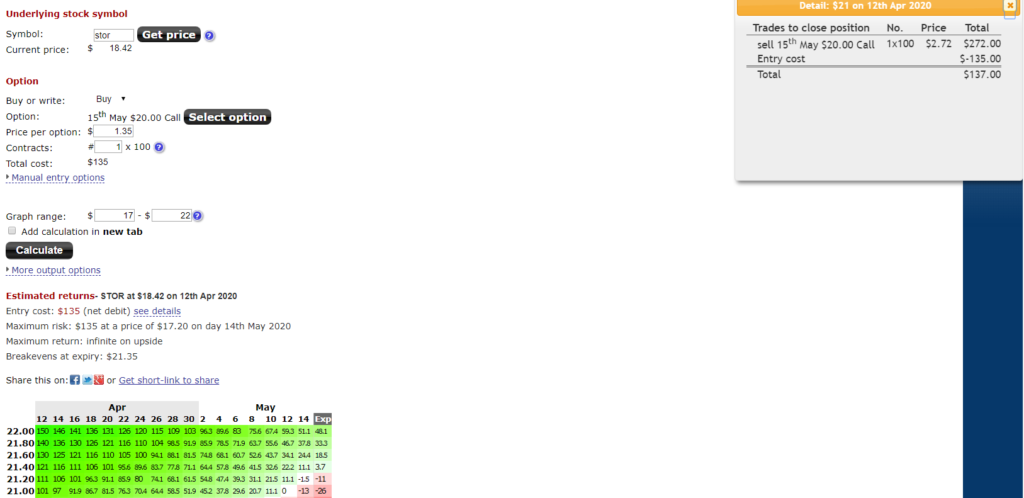

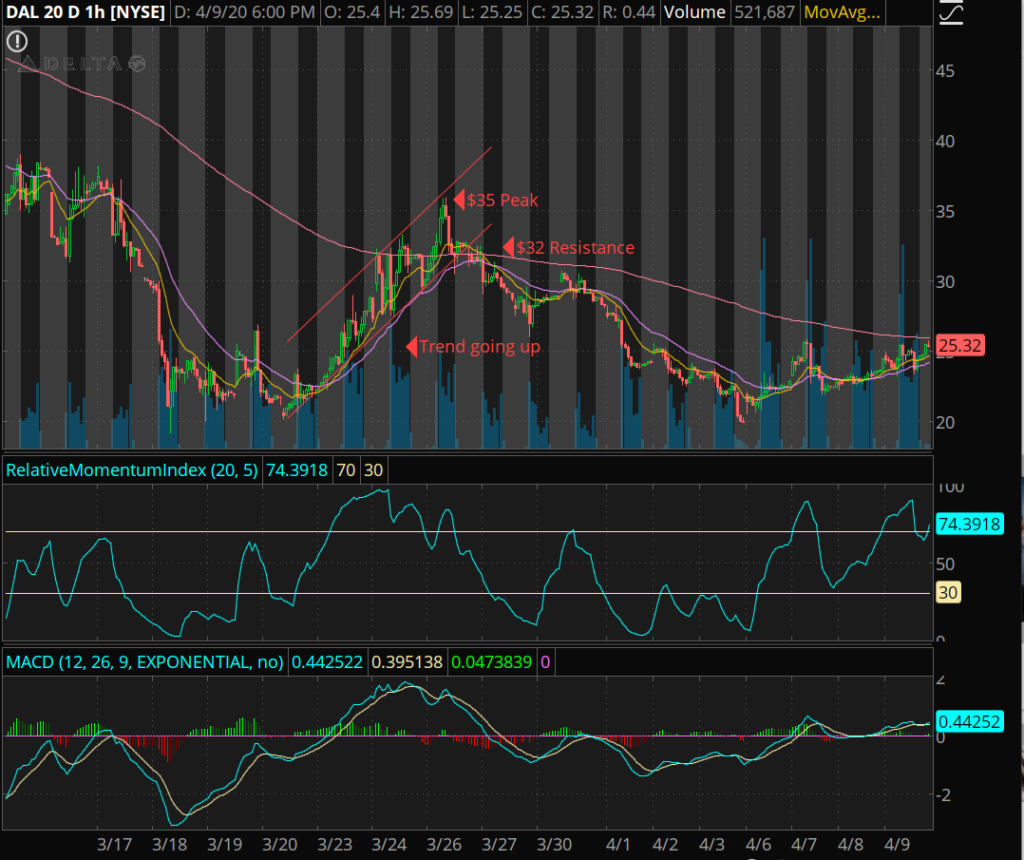

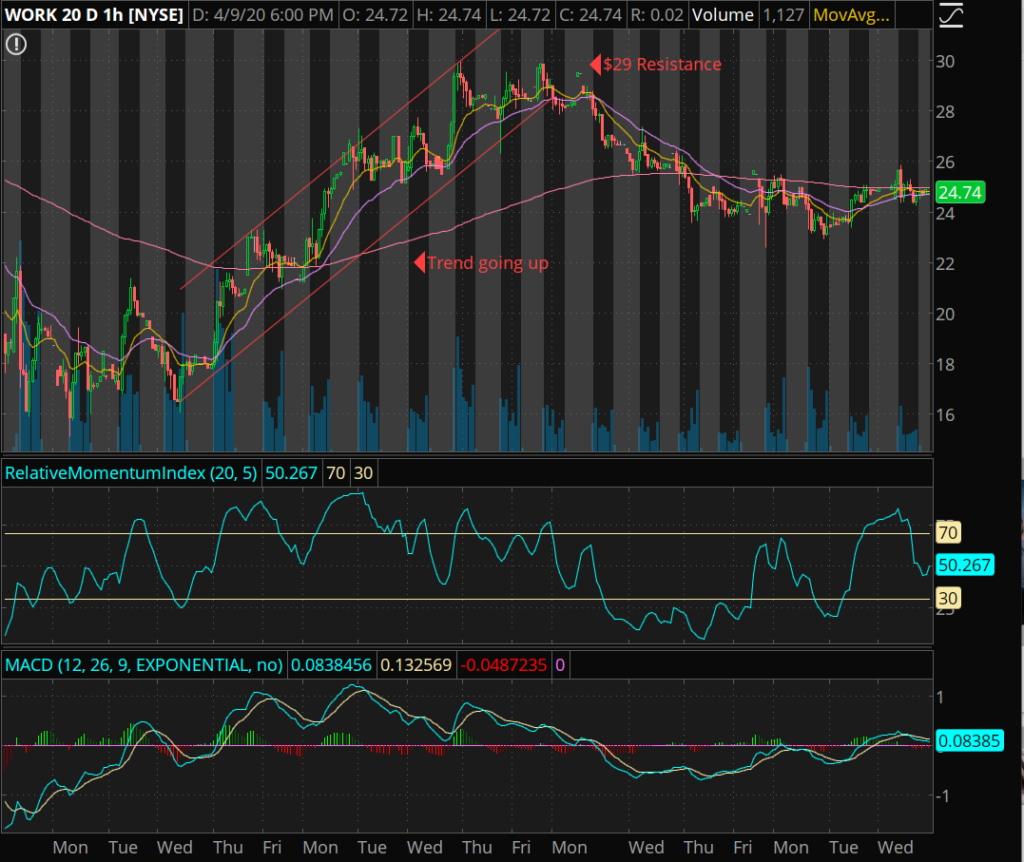

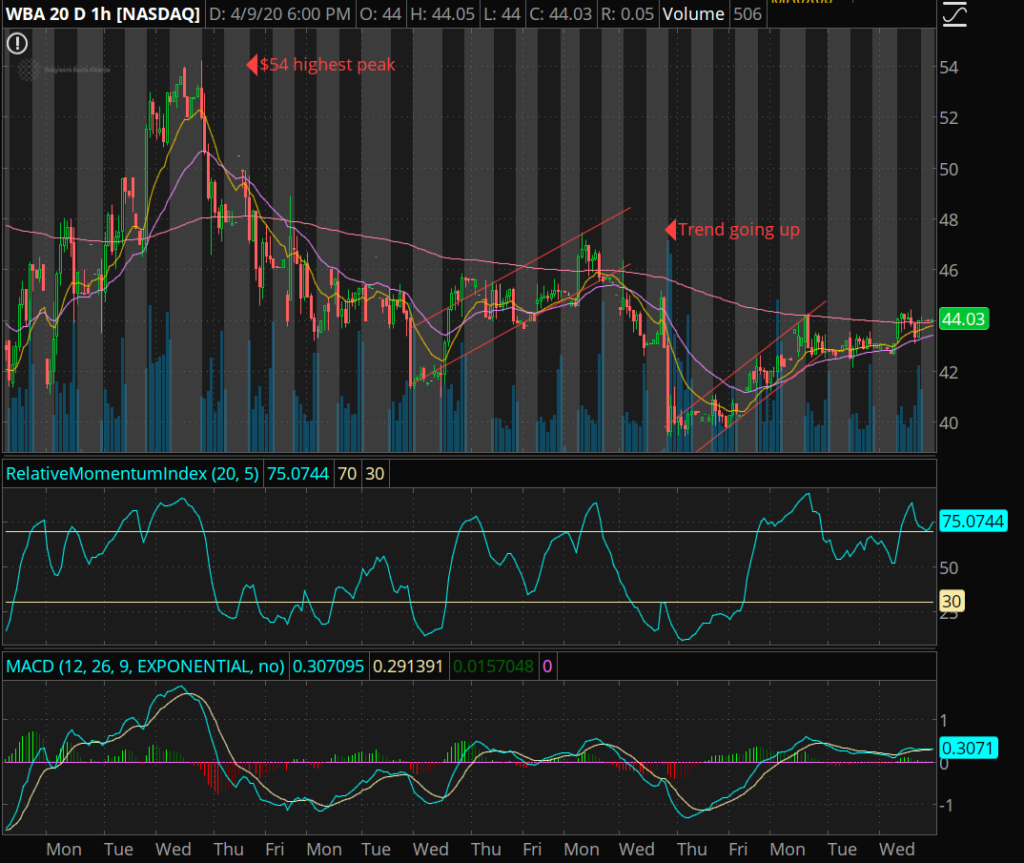

If some of these technical indicators are new to you, check out the videos tab on the website!

Stay tuned, learn more, ask questions. Become a 6 digit survivor. Check out the live stream.

Join my robinhood team and get a free stock here

Learn about my Indicators here.

Become a member and learn!

Disclaimer:

I want to point out, I am not a registered investment adviser or broker/dealer. I am a highly profitable options trader who has been successful time after time, and I have changed the lives of many people through the art of trading on the stock market.

– Ken