Hey guys!

Covid is finally dying out and things are beginning to open back up! I wanted to release a refresher to make sure you are keeping up with your homework on the stock market!

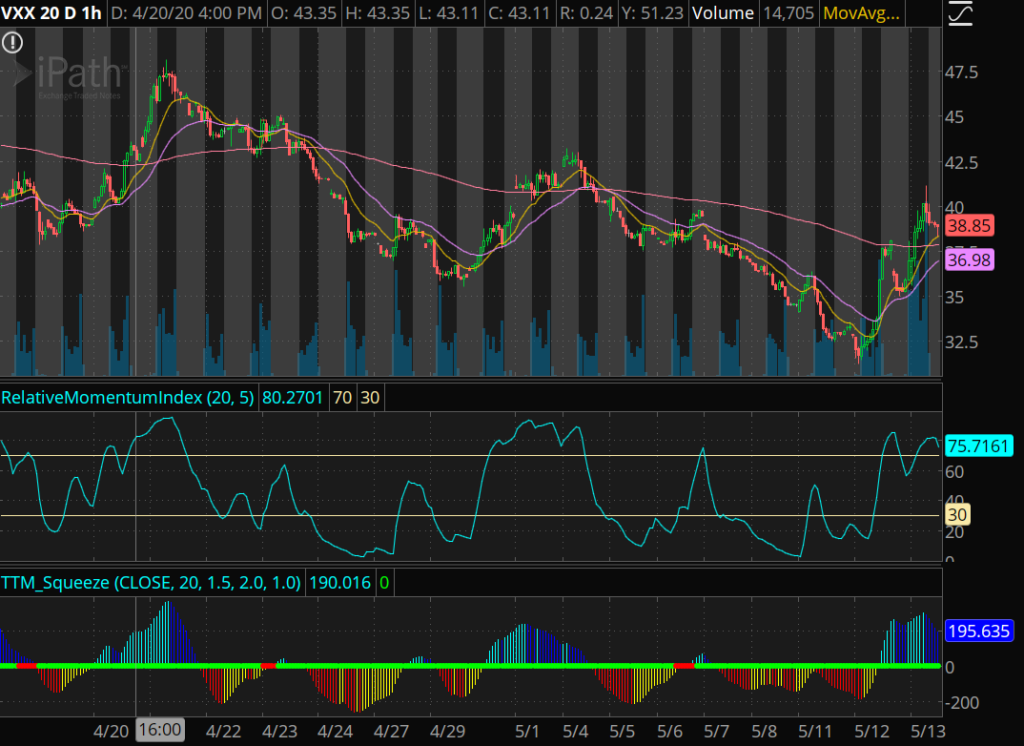

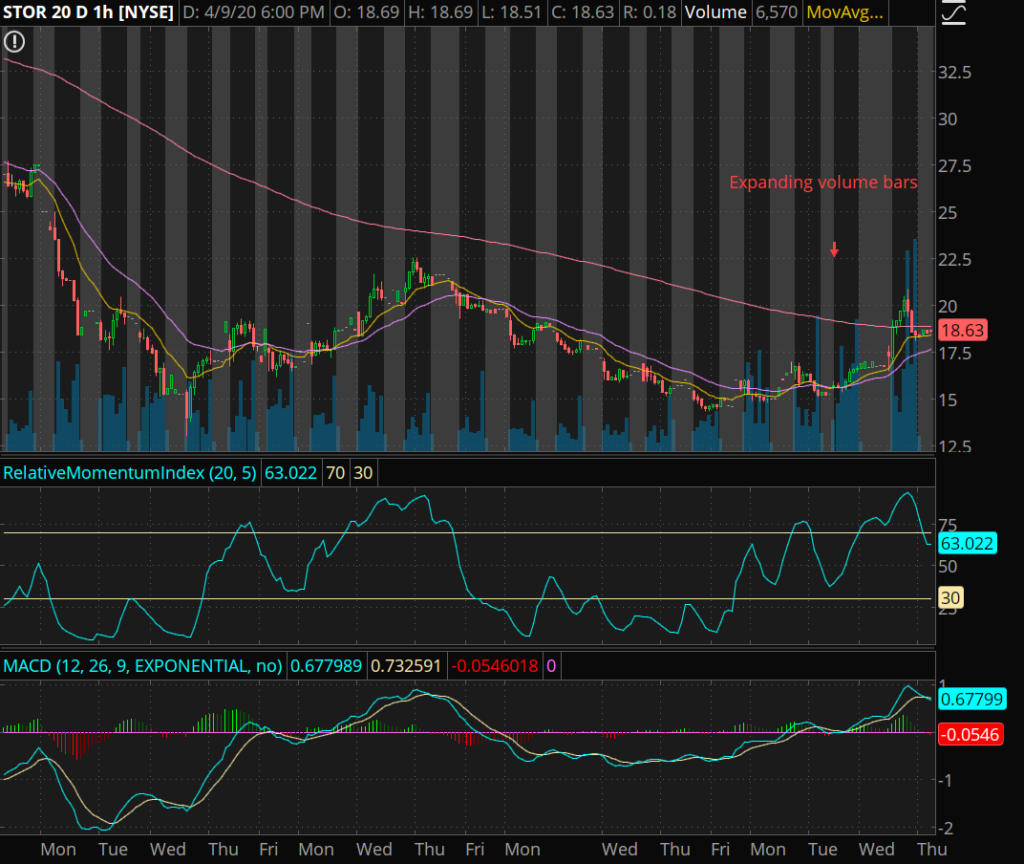

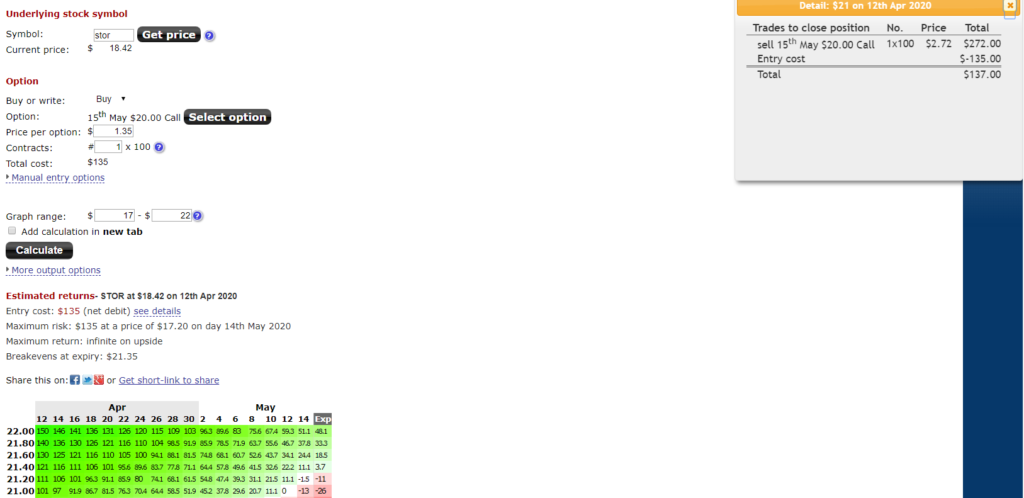

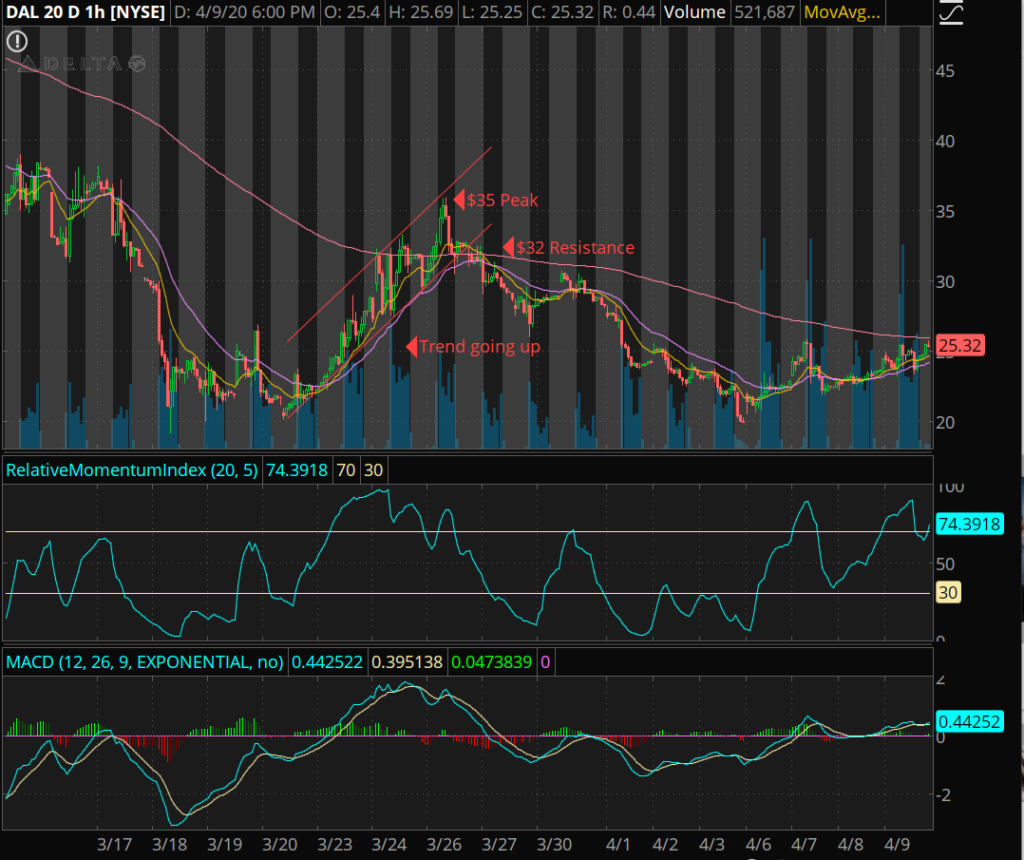

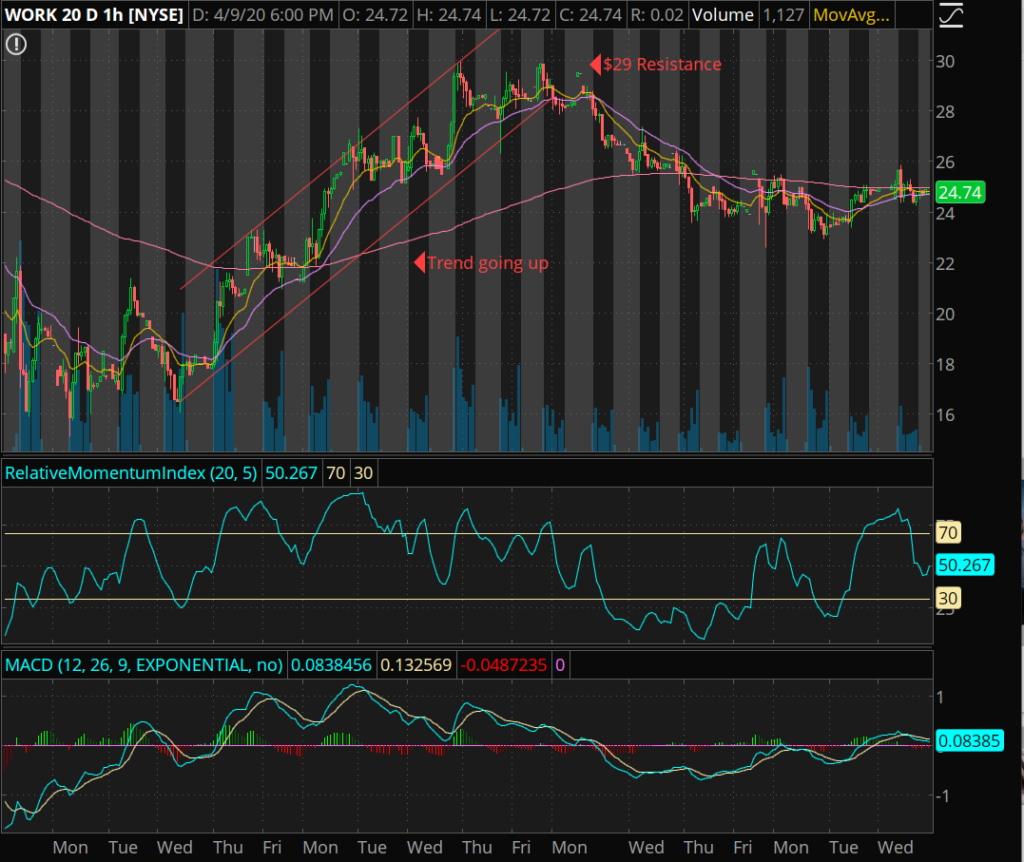

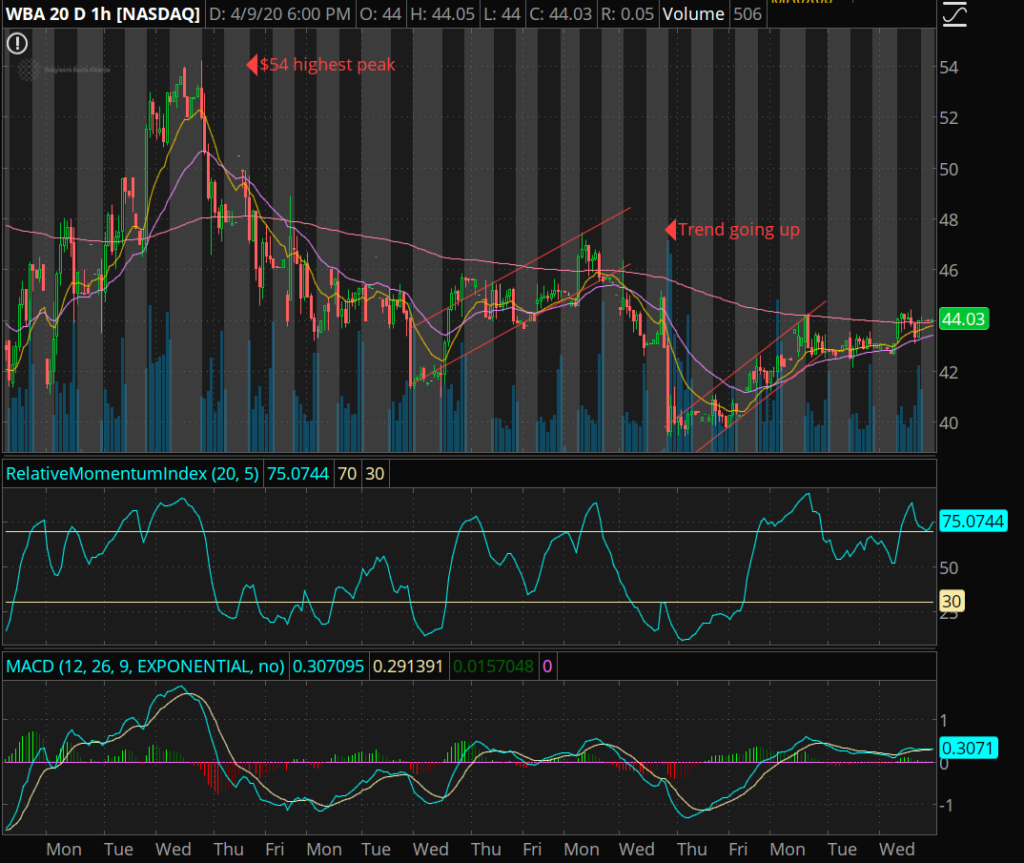

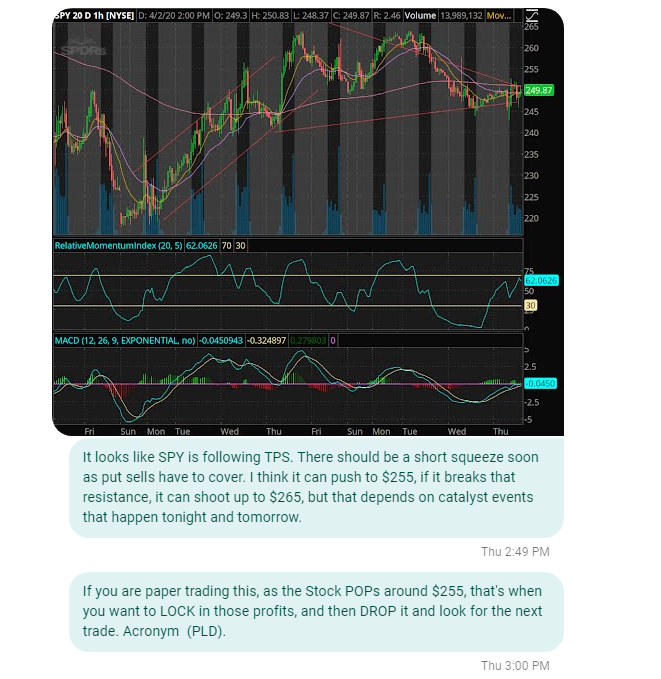

I talk about the indicators that I use and how they can make you more profitable!

If some of these technical indicators are new to you, check out the videos tab on the website!

Stay tuned, learn more, ask questions. Become a 6 digit survivor. Check out the live stream.

Join my robinhood team and get a free stock here

Learn about my Indicators here.

Become a member and learn!

Disclaimer:

I want to point out, I am not a registered investment adviser or broker/dealer. I am a highly profitable options trader who has been successful time after time, and I have changed the lives of many people through the art of trading on the stock market.

– Ken