Hey guys!

This is part 1 of our exclusive zoom call with the CEO of RYSE Inc.

OTN – Vetting an investment in RYSE Inc Reg A+ Part 1

#angelinvesting #investments #privateequity

This is exclusive raw footage of the vetting process at the OTN. I am giving you a behind the scenes look at what it is like to be an angel investor from my perspective. Today, we have Trung Pham, the CEO of RYSE Inc. Ken Ma, the founder of the Options and Traders Network, and John White, an avid angel investor.

Check out their presentation on Dragon’s Den (Canadian Shark tank!)

Dragons Den:

You can invest and review the SEC offering of RYSE Inc if you like what you see!

Investment Page: https://invest.helloryse.com/

Only a $499.10 minimum for 70 class B ownership shares

SEC Offering Circular: https://bit.ly/3iyHMFT

Interested in being vetted by the OTN? Interested in being invited to exclusive zoom calls? Like, share, and join our network!

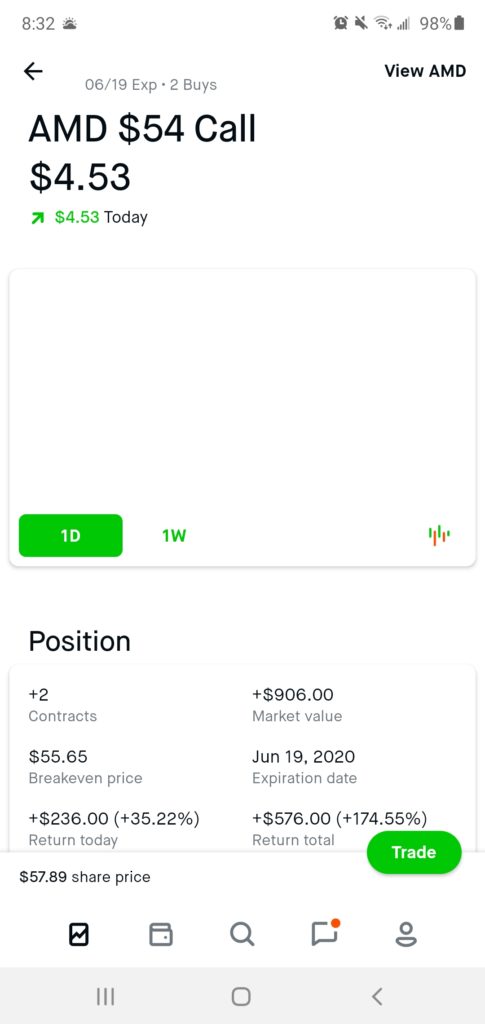

My personal portfolio: https://www.optionsandtraders.com/portfolio

Disclaimer: This is not a paid advertisement.

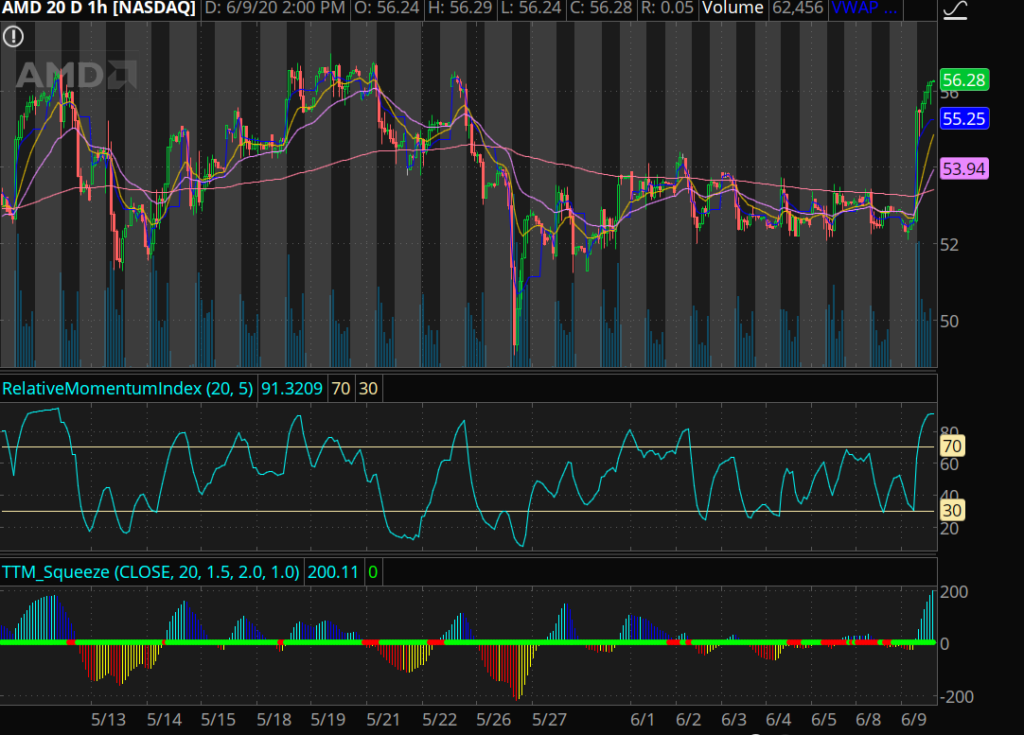

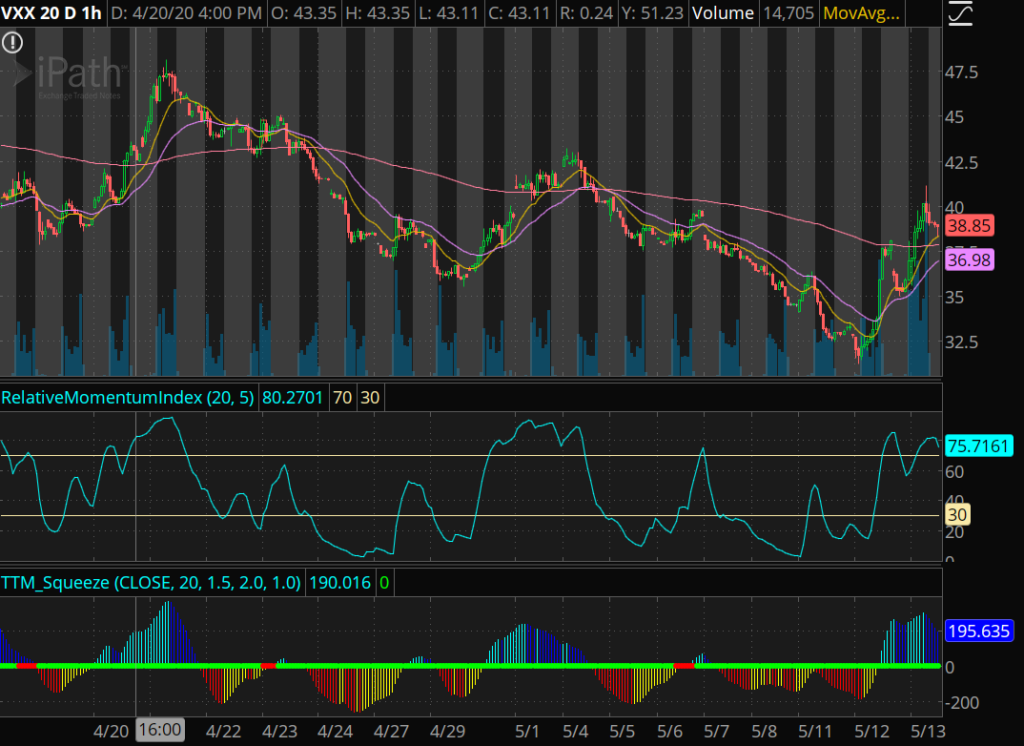

If some of these technical indicators are new to you, check out the videos tab on the website!

Stay tuned, learn more, ask questions. Become a 6 digit survivor. Check out the live stream.

Join my robinhood team and get a free stock here

Learn about my Indicators here.

Become a member and learn!

Disclaimer:

I want to point out, I am not a registered investment adviser or broker/dealer. I am a highly profitable options trader who has been successful time after time, and I have changed the lives of many people through the art of trading on the stock market.

– Ken