Ken here,

This is a question people have trouble answering. Let me give you the answer.

“You don’t hustle with your side money, because you are scared or you don’t know what to do with it!”

I use to be stuck in the same predicament. I had money in the bank, and I knew I wanted to invest, I knew I wanted to grow my wealth.

Where do I get started? What do I do? Real estate costs a ton of money to start, I have some money, but not enough to purchase real estate . . .

I want to erase one myth and give you my solution.

Myth: The stock market requires a lot of money to make money.

THIS IS A FRICKEN LIE! Whoever has told you this . . . SHAME ON THEM! I have made plenty of money from almost no money and I can do it over and over again. Just check out my $500 to $10,000 challenge live stream, I will show you how to do it in real-time.

So what did I do?

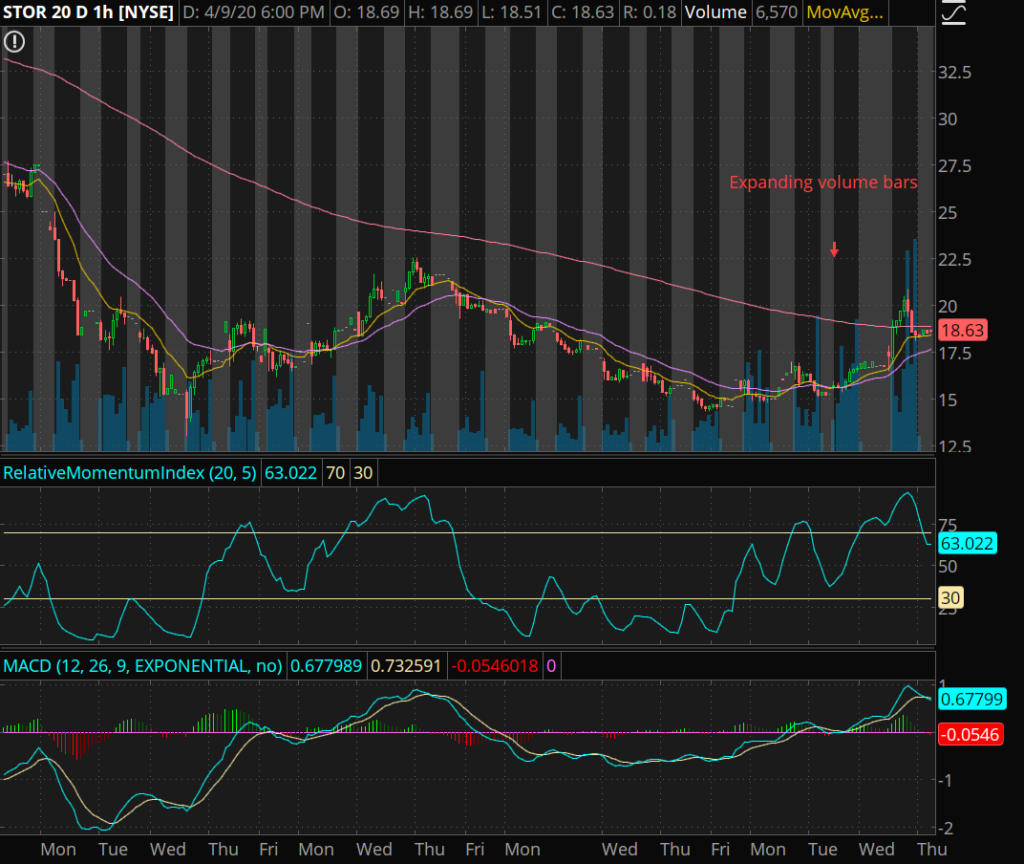

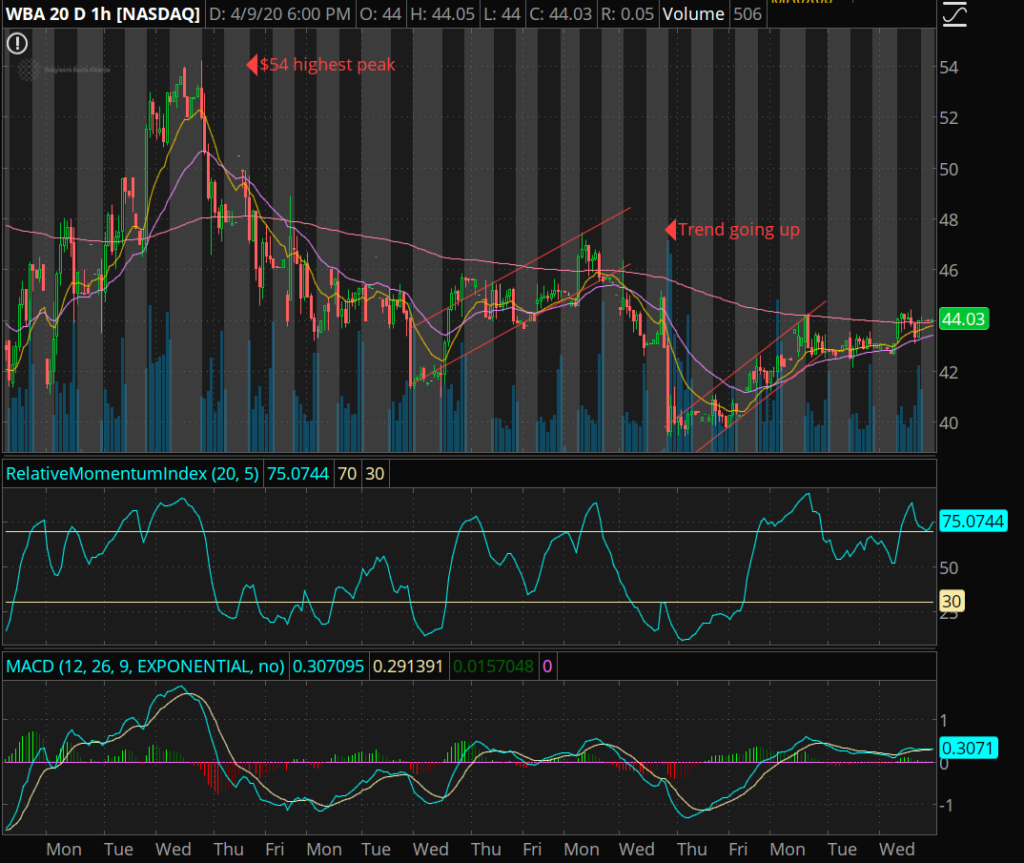

I learned the high income skill of trading options on the stock market. Options provide a ton of leverage, so you don’t need a whole lot of money.

Options give you the leverage of 100 shares of a stock without having the capital to purchase 100 shares. Think about that, you pay a fraction, and make 10 times the money!

That is what I call productivity.

My mentor always stressed the definition of productivity to me. I want you to grab a pencil, a notebook, a pen, a piece of paper, or fricken just write this on the back of your hand.

“Don’t listen to naysayers and the ignorant who tell you all you gotta do is work harder and harder and spend more work and more time to do something in life.”

90% of these people are unproductive. They just waste time. Harder, and more work is not the answer. Using more time for the same task that only yields little progress is not the answer.

The KEY definition to SUCCESS is productivity.

This is the millionaire-mindset definition: Productivity equals MORE RESULTS in LESS TIME.

This DOES NOT MEAN you don’t have to do WORK.

You still have to put in the work, but get more done with less time.

Keep up the good work!

Stay tuned, learn more, ask questions. Become a 6 digit survivor. Check out the live stream.

Join my robinhood team and get a free stock here

Learn about my Indicators here.

Become a member and learn!

Disclaimer:

I want to point out, I am not a registered investment adviser or broker/dealer. I am a highly profitable options trader who has been successful time after time, and I have changed the lives of many people through the art of trading on the stock market.

– Ken