#areahype #hypexapp #local

AreaHype Route to the Farmers Market!

Download today!

Check out what we do!

————————————————————————————————————————–

Download today!

https://hypex.app/h/download

iOS – Download

Android – Download

Check out what we do!

https://areahype.onuniverse.com/

Disclaimer: This is not a paid advertisement.

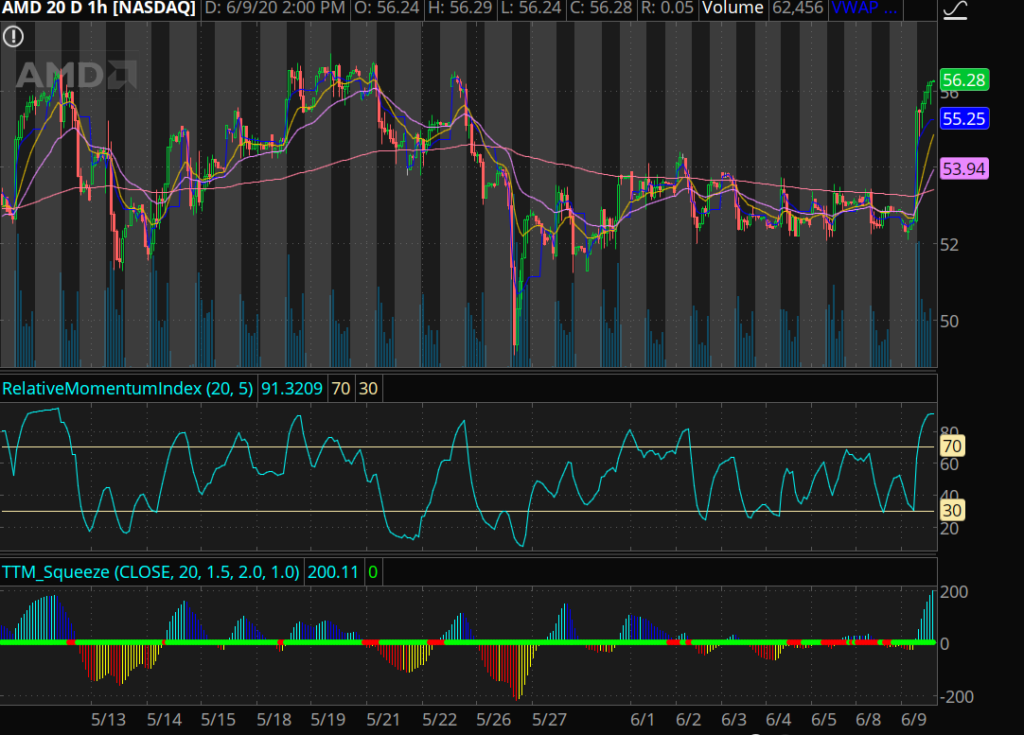

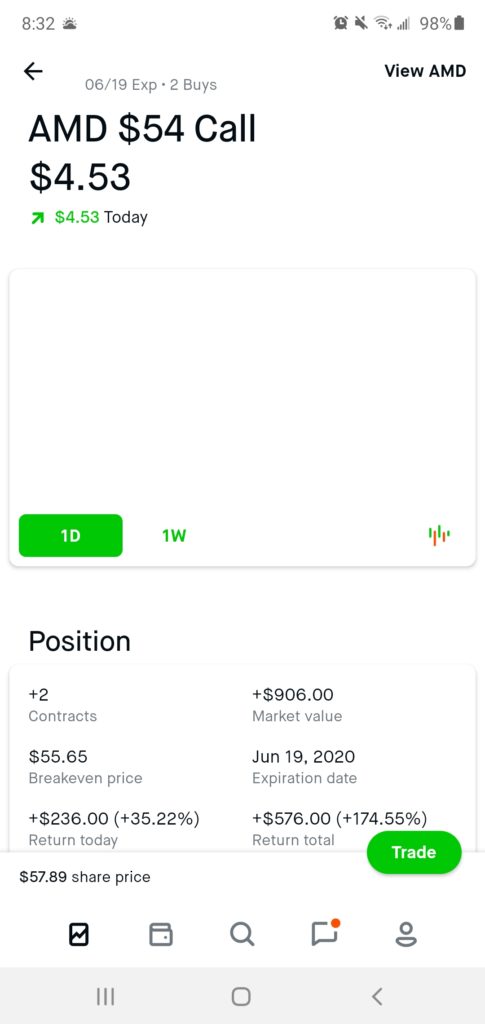

If some of these technical indicators are new to you, check out the videos tab on the website!

Stay tuned, learn more, ask questions. Become a 6 digit survivor. Check out the live stream.

Join my robinhood team and get a free stock here

Learn about my Indicators here.

Become a member and learn!

Disclaimer:

I want to point out, I am not a registered investment adviser or broker/dealer. I am a highly profitable options trader who has been successful time after time, and I have changed the lives of many people through the art of trading on the stock market.

– Ken